- Closelooknet

- Posts

- What I'm buying, selling & eyeing - Part 1 (Macro and more)

What I'm buying, selling & eyeing - Part 1 (Macro and more)

Investment update - 20 January 2024

What I'm buying, selling & eyeing - Part 1 (Macro and more)

Investment update - January 20, 2024

What happened

This week culminated with the S&P 500 and the Nasdaq 100 reaching new highs. The former surpassed its previous record of 4,818 on January 3, 2022, after 511 days. This marks the 6th most prolonged duration since 1950 to achieve a new peak. Over the last five years, the S&P 500 has yielded an impressive 81.62% return—the surge to new highs commenced with Wednesday's retail sales report. Retail sales experienced a 0.6% increase in December, surpassing the 0.4% projection. This represents the highest y-o-y growth in two years, marking the ninth month of gains. The rise in consumer spending indicates an economy far from recession.

Nasdaq 100 may soon be completing the 5th leg of the impulse wave that started in autumn 2022.

Friday brought encouraging news, with the Michigan Consumer Sentiment Index climbing by 13%, reaching its highest point since July 2021. At the same time, inflation expectations continued to decline. Americans are optimistic about inflation and hold positive views about the economy. Buoyed by AI-related solid demand, bellwether stock TSMC reported better earnings and raised the guidance for 2024. Unsurprisingly, Nasdaq 100 led stocks north; after all, it was options expiration day.

University of Michigan 2024

Is it Goldilocks?

Three aspects warrant vigilance in particular.

(1) One peculiar data point was the New York Empire State Manufacturing Index, dropping to an unprecedented -43.7 (excl. the COVID period), much lower than the anticipated -5. This contrasts with a positive six-month outlook of 18.8%, a contradictory report.

(2) The Insider Transactions Ratio is a critical aspect with insights into corporate insiders' sentiments. Currently, it is skewed towards sales over buys at 145:1, indicating concerns among insiders as Q4 earnings approach. Historically, readings under 12:1 are bullish and over 20:1 bearish. This ratio is noteworthy, esp. given the previous trend of significant selling at the last stock market peak.

Source: Puru Saxena

(3) The yield curve inversion is another point of consideration. Over the last 70 years, patterns have shown that post-inversion equity market rallies are typically not sustained, often reversing into downturns.

Source: Kurt Altrichter

Now what?

The recent trend of defying widespread expectations is intriguing. The Godot recession did not materialize. The negative outlook for the stock market in 2023 proved incorrect. 91% of fund managers anticipate lower short-term interest rates, implying expectations for a smooth economic transition and effective inflation control.

The consensus is something to monitor closely. A recent fund managers survey indicates diminishing recession fears, with 41% not foreseeing a recession in 2024 – a much higher percentage than a while ago.

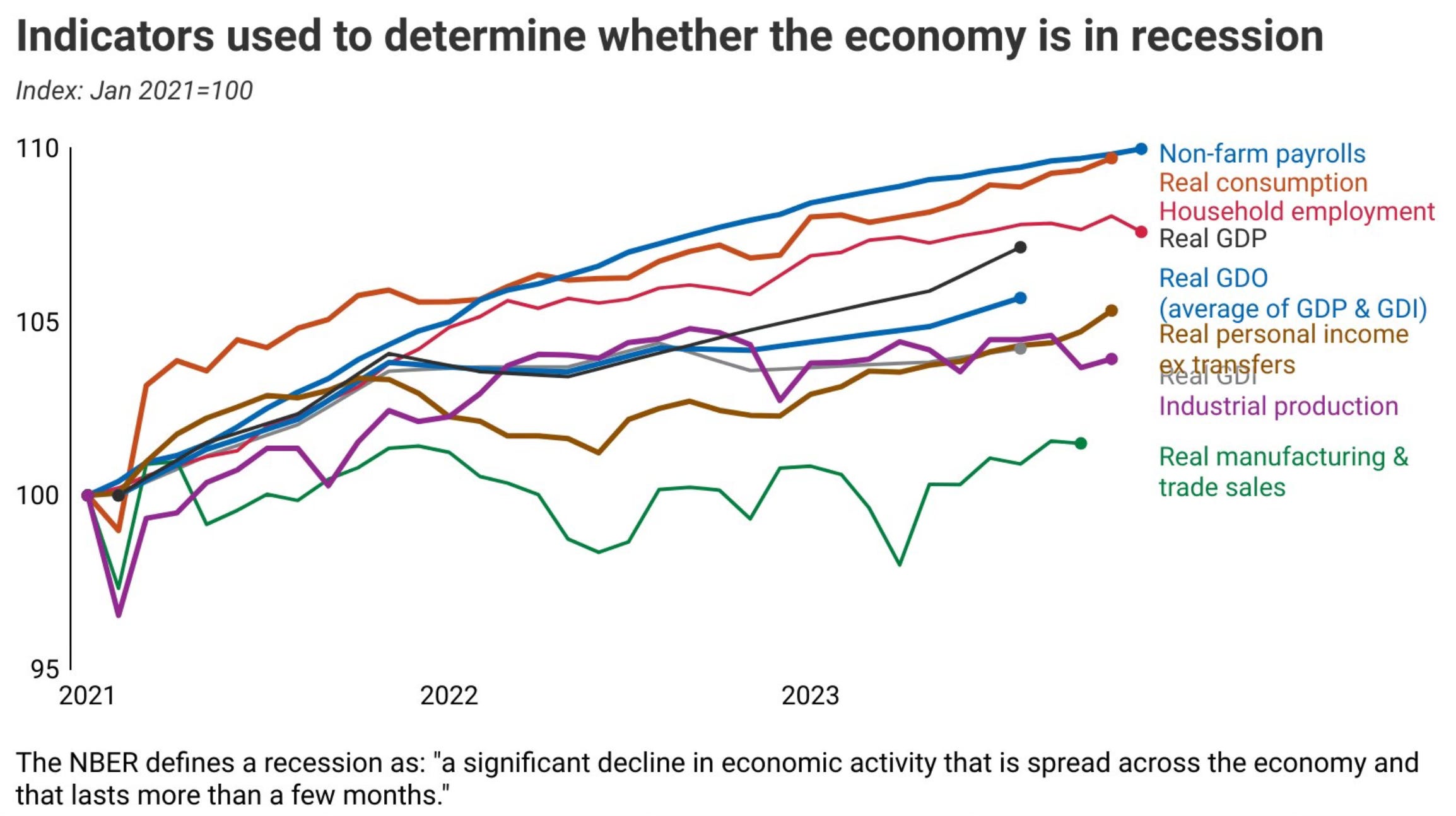

A chart that combines important readings on inflation is the one below. It is from Justin Wolfers and shows that the US economy is far from recession. It seems as if there is not a lot to worry about currently.

Something that makes me worry a bit more than usual

Source: Justin Wolfers

Part 2 of the investment update is scheduled for January 21, 2024, and will cover Elliott wave analysis, buy/sell signals, trading strategies for selected stocks and markets, and portfolio updates.

It is for newsletter subscribers. Please click the below link to sign up or spread the news. It is free: